What is Accounting Software?

According to Oracle, Best Accounting software is Accounting software manages and records the day-to-day financial transactions of an organization across revenues, expenses, assets, and liabilities.

Accounting software is an essential tool for your business’ financial data. Let’s know more about it.

“Discover the best accounting software for your business needs. Our top picks include user-friendly interfaces, powerful financial tracking capabilities, and integrations with popular apps. Find the perfect fit for your organization today!

Accounting software is an important tool for businesses of all sizes. It helps to streamline financial processes and automate tedious tasks, allowing companies to focus on growth and expansion. It might be difficult to choose the best software for your company because there are so many options on the market.

This article will discuss the top 11 accounting software options available, including features, pricing, and customer reviews. Whether you are a small business owner or a large corporation, there is a trending accounting software solution that will meet your needs.

Why is it essential to have accounting software?

Accounting software is vital for any business, large or small. It helps keep track of financial transactions, manage expenses, and generate financial reports. Here are a few reasons why the best accounting software is so essential:

Improved Efficiency

Accounting software automates many tasks that would otherwise have to be done manually. This saves time and reduces the risk of errors, allowing you to focus on other important aspects of your business.Accurate Financial Reporting

The best accounting software generates financial reports automatically, ensuring that they are valid and up-to-date. This is essential to make informed business decisions and comply with tax laws.Better Record Keeping

The best accounting software allows you to store all your financial records in one place, making it easy to access and analyze them. This is especially useful for tax season and for providing information to investors and lenders.Cost-Effective

Accounting software is much more cost-effective than hiring a full-time accountant or bookkeeper. It also allows for easy access for multiple users, which is especially helpful for small businesses and start-ups.Better Oversight And Control

With the best accounting software, you can keep track of your business’s financial performance in real-time. This allows you to make adjustments and stay on top of your expenses.

In conclusion, accounting software is a very important tool for any business. It improves efficiency, ensures accurate financial reporting, and provides better oversight and control.

Furthermore, it is cost-effective and allows for easy access for multiple users, which is especially helpful for small businesses and start-ups.

Which accounting software is best for you?

When choosing the best accounting software, it’s essential to consider the specific needs of your business. Consider the size of your business, the number of employees, and the types of financial reports you will need to generate. With so many options available, you are sure to find the right accounting software for your business.

When managing your finances, having the right accounting software is essential. From tracking expenses to generating financial reports, the right accounting software can make your life much easier. However, selecting one can be difficult given the abundance of possibilities.

Some key features to consider when choosing accounting software for your business

When choosing the best accounting software for your business, a few key factors must be considered to ensure you select the best option for your specific needs.

Features

The first thing to consider is the features offered by each software. Some standard features to look for include invoicing, expense tracking, bookkeeping, and tax preparation. Ensure the software has all the important features of your business.

Ease of use

The second factor to consider is ease of use. The software should be easy to navigate and understand, even for non-accountants.

Integration

It is essential to consider if the software can integrate with your existing systems, such as your website or payroll software, to streamline your workflow.

Cost

Of course, the cost of the software is a vital factor to consider. Be sure to compare pricing options, including monthly or annual fees and additional charges for additional users or features.

Support And Training

Finally, consider the level of support and training offered by the software company. Make sure they have a responsive customer service team to answer questions and provide guidance.

After considering these factors, you should be able to select the accounting software that best fits your needs. Some popular options include QuickBooks, Xero, and Wave. Try out a few different options with a free trial and see which works best.

Here are the top 11 accounting software options to consider

1. QuickBooks

QuickBooks is a trending accounting software for small and medium-sized businesses. It offers various features, including invoicing, bill tracking, financial reporting, and inventory management. The software is available in multiple versions, such as QuickBooks Online, QuickBooks Desktop, and QuickBooks Self-Employed.

QuickBooks Online is a cloud-based solution that allows users to access their financial data from anywhere with an internet connection.

At the same time, QuickBooks Desktop is traditional software installed on a computer. QuickBooks Self-Employed is designed specifically for freelancers and self-employed individuals.

Additionally, QuickBooks offers add-on services such as payroll, payments and merchant services, and online banking integration. These services can help businesses automate financial operations and improve efficiency.

Features offered by QuickBooks

- Automated data entry and categorization of financial transactions

- Invoicing and billing capabilities

- Ability to track expenses and generate expense reports

- Bank and credit card account reconciliation

- Sales and income tracking

- Generating financial reports, such as profit and loss statements and balance sheets

- Budgeting and forecasting tools

- Payroll processing and tax compliance

- Integration with other business tools, such as point of sale systems and e-commerce platforms

- Accessible via web and mobile app.

Pricing

QuickBooks offers a range of pricing options starting at $25 per month for the self-employed plan and going up to $150 per month for the advanced plan.

A free 30-day trial is also available for users to try out the software before committing to a subscription.

2. Xero

Xero is a cloud-based accounting software that offers various services to help businesses manage their finances. It allows users to easily track income and expenses, create invoices and bills, and manage bank transactions.

The software also features a dashboard that provides real-time financial insights and allows easy reporting. Additionally, Xero offers integrations with various other business tools, such as payroll and inventory management software. Its user-friendly interface and mobile app make it easy for businesses to access their financial information from anywhere, at any time.

With Xero, companies can streamline their accounting processes and make better financial decisions.

Features offered by Xero

- Cloud-based, accessible from any device with internet connection

- Automated bank feeds to easily import transactions and reconcile bank accounts

- Invoicing and bill payment functionality

- Inventory management and tracking

- Multi-currency support for international transactions

- Collaboration tools for team members and advisors

- Integration with over 700 third-party apps, such as Shopify and QuickBooks

- Tax and compliance reporting and filing

- Customizable dashboard and reporting options

- 24/7 customer support and online resources

Pricing

Xero offers a range of pricing plans starting at $20 per month for the “Early” plan and going up to $70 per month for the “Growing” plan.

They also offer a “Starter” plan for $10 per month for new businesses.

3. Sage 50cloud

Sage 50 cloud accounting software is a powerful tool for businesses of all sizes to manage their finances and accounting tasks. Its cloud-based technology allows users to access the software from anywhere and collaborate with team members in real-time.

The software offers various services, including invoicing, inventory management, payroll, and budgeting. It also provides detailed financial reports and analytics to help businesses make informed decisions. Additionally, Sage 50 cloud accounting software integrates with other popular apps such as QuickBooks, Xero, and Microsoft Office, making it easy to transfer data and collaborate with other teams.

Overall, Sage 50 cloud accounting software is an excellent option for businesses looking for a comprehensive and user-friendly trending accounting solution.

Features offered by Sage 50 cloud

- Automated data entry and bank reconciliation

- Invoicing and billing capabilities

- Financial reporting and analysis tools

- Multi-currency support

- Inventory management and tracking

- Sales and purchase order management

- Payroll management and compliance

- Integration with other software, such as QuickBooks and Microsoft Excel

- Cloud-based access and data storage for remote access and collaboration

- Mobile app for on-the-go access and updates.

Pricing

Sage 50cloud starts at $40 per month for the Basic version and goes up to $150 per month for the Premium version.

A one-time purchase option is also available for $299.

4. FreshBooks

FreshBooks is a popular cloud-based accounting software designed to help small businesses and freelancers easily manage their finances. It offers various services, including invoicing, expense tracking, time tracking, and project management.

With its user-friendly interface, FreshBooks makes it easy to create professional-looking invoices, track expenses, and monitor time spent on projects. Additionally, it integrates with various popular apps and tools, such as PayPal and Google Calendar, making it a versatile and convenient option for businesses of all types. With FreshBooks, companies can streamline their financial processes and focus on growing their business.

Features offered by FreshBooks

- Easy to use, intuitive interface for creating and sending invoices, tracking expenses, and managing clients

- Built-in time tracking feature for tracking employee hours and billable time

- Integration with popular payment gateways for easy online payments

- Mobile app for tracking expenses and creating invoices on the go

- Customizable invoice templates and branding options

- Ability to set up recurring invoices for regular clients

- Detailed reporting and financial analysis tools

- Option to add team members and collaborate on projects and finances

- Automatic reminders for unpaid invoices and overdue payments.

Pricing

FreshBooks offers a variety of pricing plans, starting at $15/month for the Lite plan and going up to $50/month for the Premium plan.

Additional team members can be added to any plan for an additional $10/month per user.

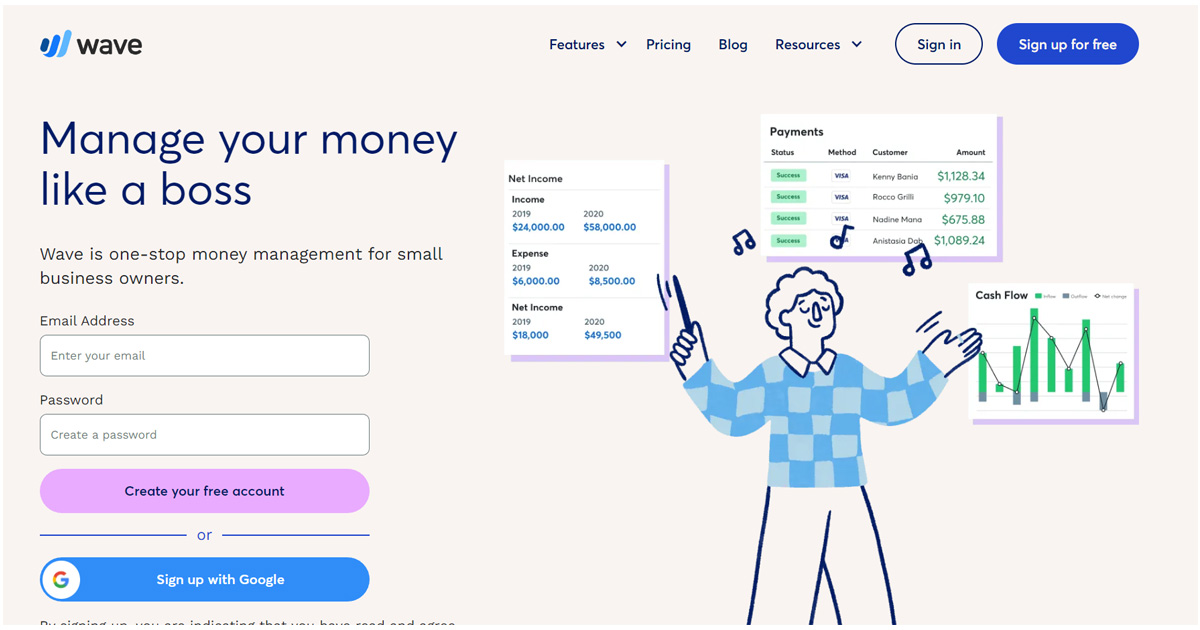

5. Wave

Wave Accounting is a cloud-based trending accounting software that provides small business owners with various financial management tools. The software includes features such as expense tracking, invoicing, and receipt scanning.

Additionally, Wave Accounting offers a suite of financial reports, including balance sheets, income statements, and cash flow statements, which can be exported to Excel for further analysis. The software also integrates with several popular business apps, such as PayPal, Stripe, and Square, allowing seamless transactions and data transfer.

Furthermore, It offered a free plan for its services for small business owners and paid plans for more advanced features. The software is user-friendly and easy to navigate, making it an ideal solution for small businesses that need to manage their finances but may need more resources to hire a dedicated accountant.

Features offered by Wave

- Invoicing and billing

- Receipt scanning and recording

- Income and expense tracking

- Bank and credit card account integration

- Tax calculation and filing

- Financial reporting

- Multi-currency support

- Collaboration and permission settings

- Automated reminders and follow-ups

- Customizable templates and branding options.

Pricing

Wave’s accounting software is free to use, but they do offer premium features for a monthly subscription fee starting at $9 per month.

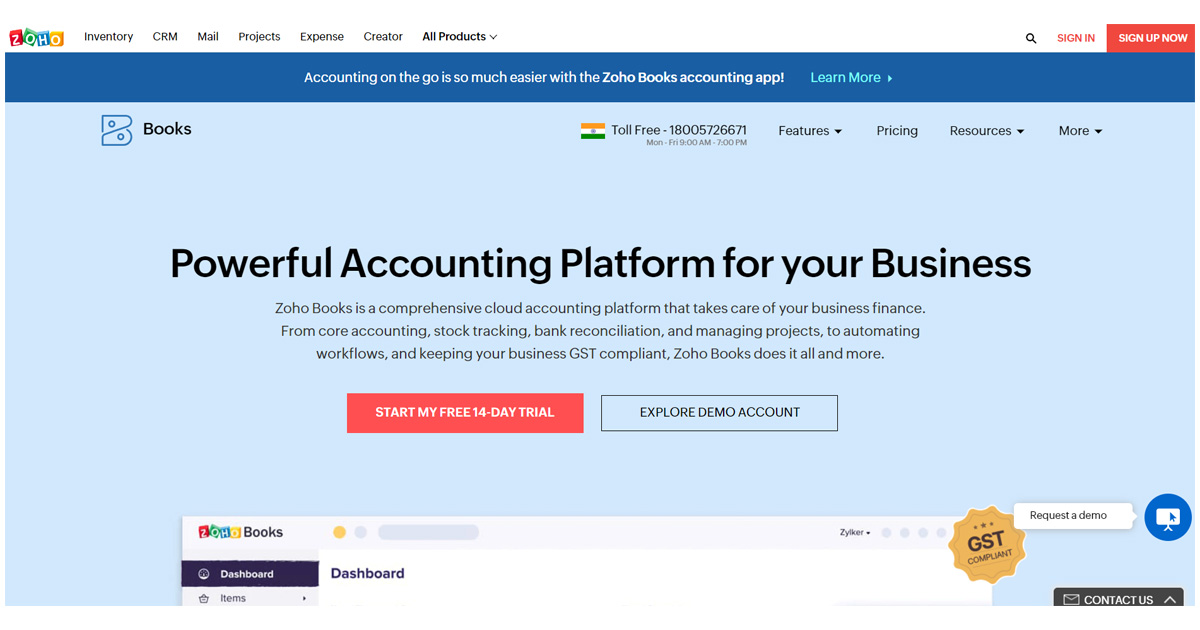

6. Zoho Books

Zoho Books is an online accounting software that offers various services to help businesses manage their finances. Zoho Books’ key features include invoicing, expense management, and financial reporting. The software also allows companies to track and manage their inventory, create purchase orders, and generate sales reports.

Additionally, Zoho Books offers integrations with other Zoho apps, such as CRM and project management software, as well as with popular third-party apps, such as PayPal and Stripe, making it easy to manage all aspects of a business in one platform.

Overall, Zoho Books is a powerful and user-friendly accounting software that can help businesses streamline their financial processes and gain better insights into their financial performance.

Features offered by Zoho Books

- User-friendly interface

- Automatic bank feeds and transaction matching

- Customizable invoicing and billing

- Detailed financial reports and analytics

- Multi-currency support

- Tax management and compliance

- Integration with other Zoho applications and third-party apps

- Mobile app access

- Collaboration and team management tools

- Secure data encryption and backup

Pricing

Zoho Books offers a free plan for up to 3 users with basic features, and pricing for paid plans starts at $9 per month per user for the Standard plan with additional features and integrations.

The Professional plan starts at $19 per month per user, and the Premium plan starts at $29 per month per user with advanced features and dedicated support.

Create Free Business Profile on Uprighte

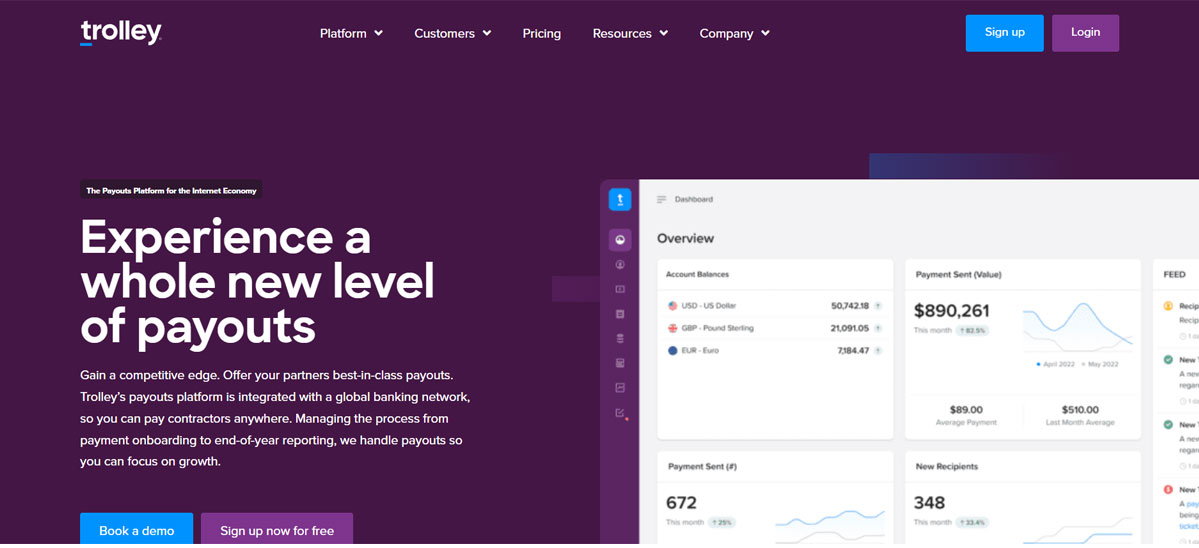

7. Trolley

Trolley is an accounting software that allows users to manage their financial operations, including invoicing, expenses, and reporting. It offers a simple and user-friendly interface, making it easy for businesses of all sizes to track their financial data.

Features offered by Trolley

- Allows for easy tracking and management of financial transactions

- Provides real-time financial reporting and analysis

- Automates tasks such as invoicing and account reconciliation

- Integrates with other business software, such as inventory management and point-of-sale systems

- Allows for multiple users to access and input data, with customizable access levels and permissions

- Provides secure, encrypted data storage and backups

- Offers a range of add-on features, such as project management and payroll integration

- Provides support and training resources for users.

Pricing

The pricing of the trolley accounting software starts at $29/month for the basic plan and goes up to $99/month for the premium plan.

A free trial is also available for users to test the software before purchasing.

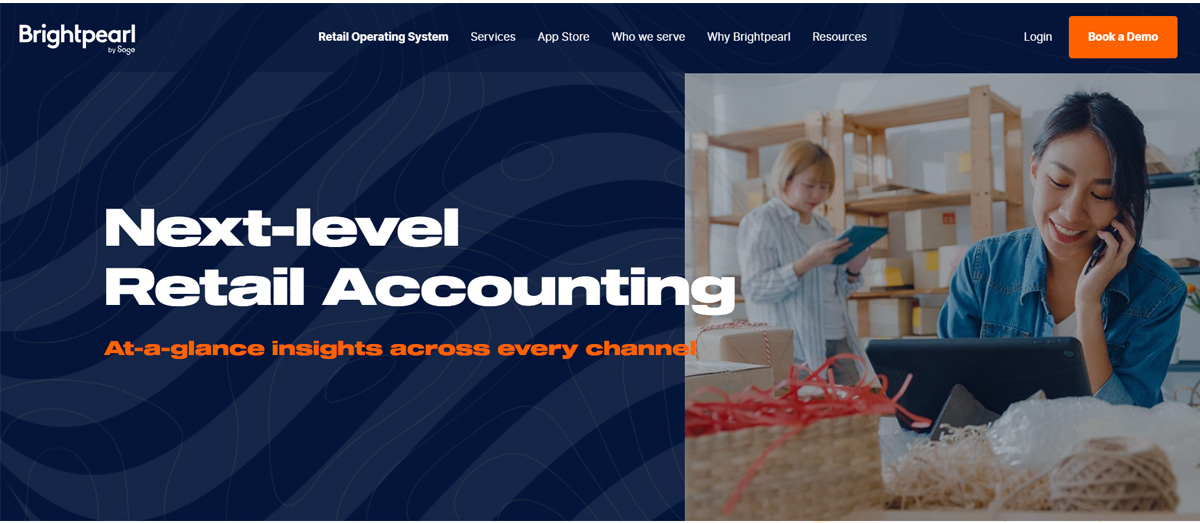

8. Brightpearl

Brightpearl is an all-in-one accounting software for small and medium-sized businesses. It offers a range of features, including inventory management, order management, financial accounting, and customer relationship management.

The software is cloud-based, which allows for easy access and collaboration among team members. Additionally, it integrates with popular e-commerce platforms such as Shopify and Magento, making it easy to manage online sales and inventory.

Brightpearl’s customer service is highly rated, providing support through email, phone, and live chat. Overall, Brightpearl is a comprehensive accounting solution that can help streamline business operations and improve efficiency.

Features offered by Brightpearl

- Integrates with e-commerce platforms such as Shopify and Magento

- Automates accounting tasks such as invoicing and inventory management

- Has a customer relationship management (CRM) system built-in

- Offers robust inventory management capabilities

- Provides access to purchase order and supplier management tools

- Offers a mobile app for on-the-go access and management

- Enables integration with popular payment gateways and shipping providers

Pricing

Brightpearl offers a range of pricing plans starting at $99 per month for the “Starter” plan, and goes up to $499 per month for the “Enterprise” plan.

Prices vary based on the number of users and the level of functionality needed.

9. Bench

Bench is a cloud-based accounting software that provides small business owners various financial management tools. It offers services such as bookkeeping, tax preparation, and financial reporting.

The software can automate many tedious tasks associated with maintaining financial records, allowing users to focus on growing their businesses. With Bench, users can easily track their income and expenses, create and send invoices, and manage their cash flow.

The software also integrates with popular apps such as QuickBooks, Xero, and Stripe, making it easy to connect all of your financial data in one place. Additionally, users can access a team of certified bookkeepers who can provide support and guidance when needed.

Features offered by Bench

- Automated bookkeeping and financial statement preparation

- Automatic bank and credit card transactions import and categorization

- Customizable income and expense categorization

- Invoicing and expense tracking

- Tax return preparation and filing integration

- Multi-currency support

- Multi-user access and permissions

- Secure cloud-based storage and data backup

- Integrations with other popular software such as QuickBooks, Xero, and Zapier

- Mobile app access for on-the-go use.

Pricing

Bench offers a monthly subscription starting at $115/month for basic bookkeeping services and $195/month for advanced bookkeeping and financial reporting services.

Custom pricing is also available for larger businesses and organizations.

10. Intuit Online Payroll

Intuit Online Payroll is a cloud-based best accounting software that helps small businesses manage payroll and tax compliance efficiently. The software offers various services, including automatic paycheck calculation, direct deposit, tax filing and payment, and employee self-service portals.

It also integrates with QuickBooks and other accounting systems to ensure seamless data transfer and accurate financial reporting. Additionally, users have access to a dedicated payroll expert who can assist with any questions or issues.

With Intuit Online Payroll, businesses can save time and reduce the risk of errors, making payroll and tax compliance a breeze.

Features offered by Intuit Online Payroll

- Automatically calculates and files payroll taxes

- Allows for direct deposit of employee paychecks

- Generates W-2 forms at the end of the year

- Provides online access for employees to view and download their pay stubs and W-2 forms

- Allows for tracking of employee vacation and sick time

- Includes compliance with state and federal tax laws

- Allows for customization of payroll settings and options

- Provides detailed reports on payroll expenses and employee information.

Pricing

Intuit Online Payroll starts at $45 per month for the Basic plan, which includes payroll processing and tax filing.

The Enhanced plan, which includes additional features such as time tracking and employee self-service, starts at $75 per month

11. MYOB

MYOB is a popular accounting software widely used by small and medium-sized businesses. It offers various services, including bookkeeping, payroll, inventory management, and tax compliance. The software is prepared to make it easy for business owners to manage their finances by providing an intuitive interface and various automated features.

Some of the critical benefits of MYOB include the ability to create invoices, track expenses, and generate financial reports. MYOB also offers cloud-based services, allowing businesses to access their data from anywhere and collaborate with their accountant in real-time.

MYOB is a versatile and user-friendly accounting software that can help businesses streamline their financial operations and make more informed decisions.

Features offered by Intuit Online Payroll

- Automatically calculates and files payroll taxes

- Allows for direct deposit of employee paychecks

- Generates W-2 forms at the end of the year

- Provides online access for employees to view and download their pay stubs and W-2 forms

- Allows for tracking of employee vacation and sick time

- Includes compliance with state and federal tax laws

- Allows for customization of payroll settings and options

- Provides detailed reports on payroll expenses and employee information.

Pricing

Intuit Online Payroll starts at $45 per month for the Basic plan, which includes payroll processing and tax filing.

The Enhanced plan, which includes additional features such as time tracking and employee self-service, starts at $75 per month

Best practices to wrap up, things

Best practices to wrap up, things

In conclusion, several accounting software options are available on the market today, each with its unique features and capabilities.

However, the best accounting software for your business will depend on your specific needs and requirements. Some popular options include QuickBooks, Brightpearl, and Acclipse, which offer robust features such as expense tracking, financial reporting, and invoicing.

Ultimately, the best accounting software for your business is the one that can meet your needs and help you efficiently manage your finances. Research and compare different software options before making a final decision.